Tax Preparation

Your CPAs Guide To The New ERC Crisis

IRS Announces Moratorium on the Employee Retention Credit and Provides Guidance for Civil Penalty Amnesty to Withdrawing Improper Claims, Also Known As - Don’t Deposit That Check and Hire Legal Counsel The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when they did not technically qualify has caused…

Wake up with our popular morning roundup of the day's top military and defense stories

Stay Updated

More Stories

Long Road To Current Battles

Introduction Most compensation earned by taxpayers is subject to employment taxes. When it comes to sole proprietors, independent contractors, and partners, employment taxes include those imposed by the Self-Employment Contributions Act (“SECA”). Rates in recent years have reached 15.3 percent of an individual’s “net earnings from self-employment,” a category which…

Navigating New Guidance On The Corporate Alternative Minimum Tax

Mike Resnick of Eversheds Sutherland discusses the effects on taxpayers of the corporate alternative minimum tax and its recently released guidance. This transcript has been edited for length and clarity. David D. Stewart: Welcome to the podcast. I'm David Stewart, editor in chief of Tax Notes Today International. This week:…

Reducing Some Risks While Creating Others?

Introduction Taxpayers, like all people, are risk averse for the most part; they want to avoid financial uncertainty to the greatest extent possible. This is difficult to accomplish when the Internal Revenue Service (“IRS”) regularly attacks certain issues, often concluding that taxpayers owe additional taxes, penalties, and interest for several…

A Look At Tax Proposals On State And Local Ballots This Election Season

All across America, voters will be headed to the polls on Tuesday, Nov. 7, 2023. It's an off-year for elections—the presidential elections aren't until next year—but there are state and local races, as well as ballot initiatives, to decide. Voters will be pulling the lever to make choices on tax…

What Is Nikki Haley’s Tax And Budget Platform?

Former South Carolina Governor Nikki Haley, who appears to be winning increasing support among Republicans in the race for her party’s 2024 presidential nomination, is running on a fairly standard GOP tax and budget platform. But it includes important twists and some inconsistencies with her record as governor. She backs…

Tax Opinions Prevent IRS Penalties, And Seven Other Things To Know

Do tax opinions protect you from the IRS? Usually yes, provided that you get one early enough. That generally means having the tax opinion in hand before you file your tax return. Many clients and tax advisers have trouble saying exactly why one should get a tax opinion or how…

7 Strategies That Can Help You Avoid Year End Tax Bracket Creep

Wage increases are generally a great thing, but the added benefit of an income increase can be offset by the higher prices of goods in times of high inflation and the possibility of being nudged into a higher tax bracket. This phenomenon is known as tax bracket creep. The result?…

Lawmakers Should Stay Out Of Microsoft Tax Dispute

Even legislators with a keen interest in protecting the U.S. corporate tax base from profit shifting should probably resist the urge to jump into the middle of Microsoft’s high-profile transfer pricing dispute with the IRS. Microsoft’s recent disclosure that the IRS believes the company paid $28.9 billion less in corporate…

IRS Releases Legal Memo Focused On ERC And Workplace Safety Guidelines

Weeks after the IRS announced a moratorium on processing new Employee Retention Credit (ERC) claims, the IRS has issued more guidance on the program. Specifically, the IRS has issued an opinion about whether an employer can rely on communications from the Occupational Safety and Health Administration (OSHA) to determine whether…

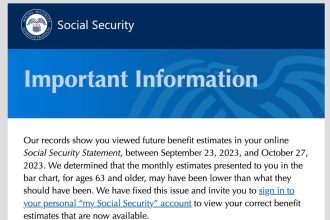

Social Security Admits Its Website Has Been Providing Crazy Estimates

In this October 20th Forbes column, I claimed that Social Security’s website was projecting lower benefits for worker than it had just a few months back. This was confirmed today in an email that Social Security sent to recent visitors. One of my company’s Maximize My Social Security software users…

Most Popular

Creative Ways Startups Can Earn Funding in Tough Economic Times

In a declining economy, startups face an uphill battle when it comes to securing funding.…

I Asked AI to Create a Plan for a Fake Company — The Results Blew Me Away, But Not in the Way You Might Think

With all of the recent news about artificial intelligence (AI), it got me thinking about…

Ideas To Transform You From Good To Better To Best

A while back, I took a couple of my grandchildren on a tour of the…

5 Crucial Challenges Startups Must Overcome

Startups face numerous challenges on their journey to success, and failing to overcome any one…