Tax Preparation

Your CPAs Guide To The New ERC Crisis

IRS Announces Moratorium on the Employee Retention Credit and Provides Guidance for Civil Penalty Amnesty to Withdrawing Improper Claims, Also Known As - Don’t Deposit That Check and Hire Legal Counsel The expansion and strong marketing tactics of good-for-nothing “accounting advisors” who encouraged taxpayers to qualify for the Employee Retention Credit (“ERC”) when they did not technically qualify has caused…

Wake up with our popular morning roundup of the day's top military and defense stories

Stay Updated

More Stories

2024 IRS Limits On 401(k) Plans Affect Nonqualified Plans

The IRS just released the 2024 contribution limits on qualified retirement plans, such as your 401(k). That’s crucial info for employees and executives who can participate in company nonqualified deferred compensation (NQDC) plans. Here’s why. For most NQDC plan participants, year-end is the time to be like an autumn squirrel…

Which Corporations Pay The Most Federal Income Tax?

Corporations report their total cash payments of income tax — federal, state, and foreign combined — but they don't identify, nor does the IRS reveal, how much federal income tax they pay. We believe, however, that we can make reasonable estimates from information reported by publicly traded companies in their…

Here’s More Evidence That Low Tax Rates Are Good For Business And The Prosperity Of Everyone

This episode of What’s Ahead discusses the newly released State Business Tax Climate Index from the renowned, nonpartisan Tax Foundation. It’s no surprise that almost all the states with the most benign business tax regimes are run by Republicans, while those with the worst are governed by Democrats. No wonder…

Tax Court Exposes Financial Engineering Of Conservation Easements

Judge David Gustafson injected a good dose of common sense into the ongoing struggle between the IRS and the syndicators of conservation easements. His opinion in Mill Road 36 Henry LLC lays bare the nonsense that has created the syndicated conservation easement industry. The story starts with undeveloped suburban land…

New Laws Threaten To Limit Foreign Ownership Of Land Across The Nation

The United States has long seen itself as an open-for-investment free-market bastion. But concerns about national security–and some political grandstanding– could close the doors to foreign buyers, particularly when it comes to farmland. By Kelly Phillips Erb, Forbes Staff The action last week by Arkansas Attorney General Tim Griffin affected…

IRS Announces Retirement Contribution Limits Will Increase In 2024

The IRS says that the amount you can sock away for retirement is going up. In 2024, individuals can contribute up to $23,000 to their 401(k) plans in 2024—up from $22,500 for 2023. And those playing catch-up get a boost, too: the catch-up contribution limit for employees aged 50 and…

IRS Opens Portal For Car Dealers To Dole Out EV Tax Credits At Point-Of-Sale

The Internal Revenue Service on Wednesday opened the portal for car sellers to register with Energy Credits Online – a site that will allow dealers to dole out the federal electric vehicle tax credit of up to $7,500 to buyers as a discount. The move marks the latest step in…

Conservation Easements – New Regulations, New Law, New Questions

Many people are baffled about the status of conservation easement donations, which is logical given all that has happened recently. Among other things, courts ruled that the IRS violated the law when calling certain things as “listed transactions,” the IRS tried to salvage the situation by issuing Proposed Regulations, and…

Proposed Regs And What’s Next

In the second of a two-episode series, Tim Jacobs of Hunton Andrews Kurth continues his discussion of the energy credits enacted in the Inflation Reduction Act and the proposed regulations. This transcript has been edited for length and clarity. David D. Stewart: Welcome to the podcast. I'm David Stewart, editor…

Who Gives A CRAT About Certain Tax-Planning Strategies? The IRS.

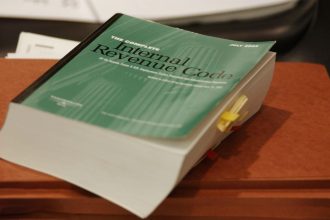

There is nothing inherently wrong with forming and utilizing a charitable remainder annuity trust (“CRAT”) for tax-planning purposes; people do it all the time. Issues arise, though, when taxpayers claim positions generating benefits that arguably exceed those contemplated by Congress and the Internal Revenue Service (“IRS”). When this occurs, enforcement…

Most Popular

Creative Ways Startups Can Earn Funding in Tough Economic Times

In a declining economy, startups face an uphill battle when it comes to securing funding.…

I Asked AI to Create a Plan for a Fake Company — The Results Blew Me Away, But Not in the Way You Might Think

With all of the recent news about artificial intelligence (AI), it got me thinking about…

Ideas To Transform You From Good To Better To Best

A while back, I took a couple of my grandchildren on a tour of the…

5 Crucial Challenges Startups Must Overcome

Startups face numerous challenges on their journey to success, and failing to overcome any one…